Leading cryptocurrency Bitcoin and altcoins started the new week with a decline, and BTC dropped a needle below $41,000.

While the decline in BTC and altcoins worried investors, CoinShares published its weekly cryptocurrency report and said that there was an outflow of $ 16 million last week.

Stating that there was a small outflow after 11 weeks of entries, CoinShares said:

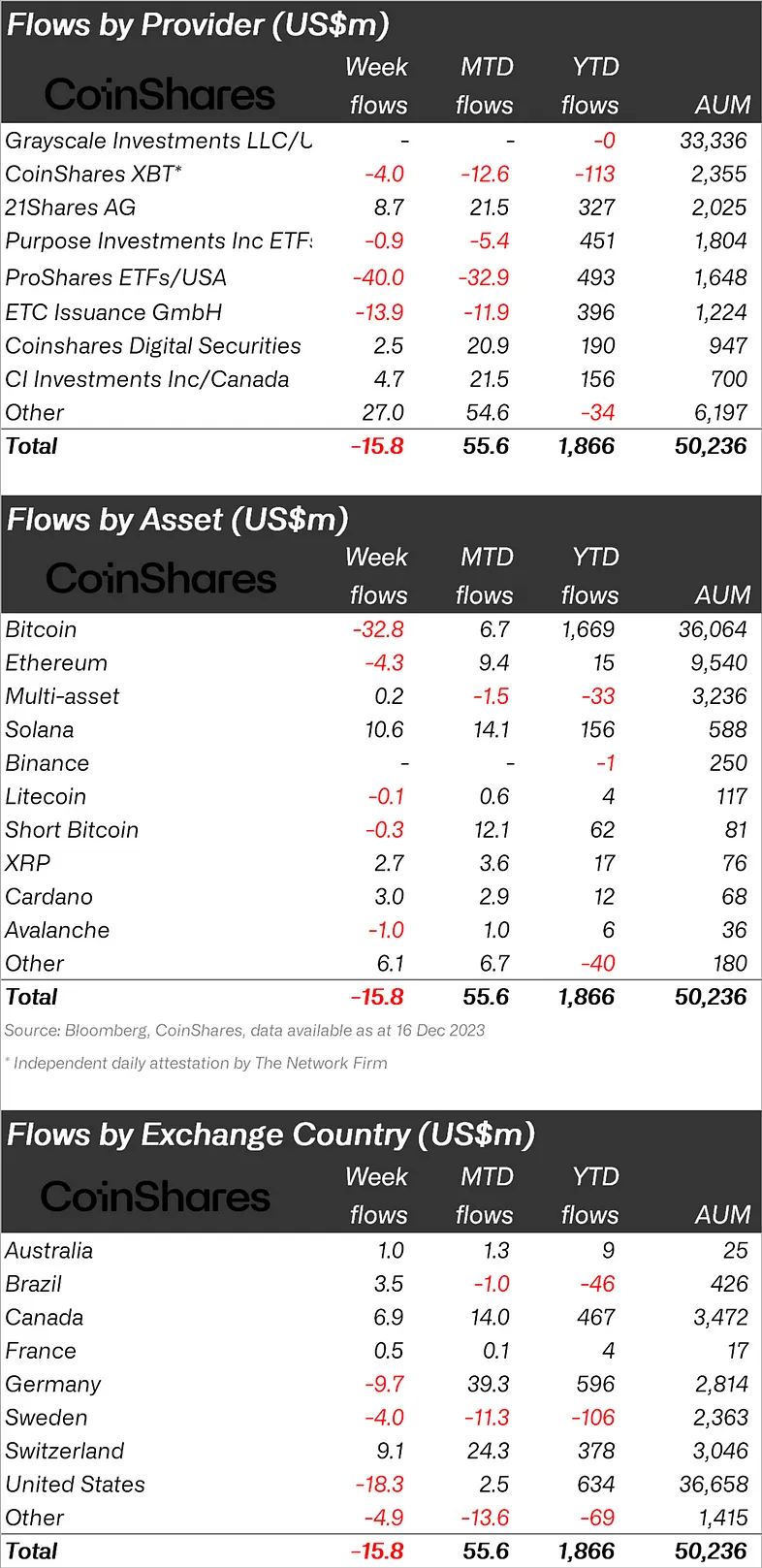

“Cryptocurrency investment products saw small outflows totaling $15.8 million last week, ending an 11-week streak of inflows.

However, trading activity remained well above the year average, totaling $3.6 billion for the week.”

When looking at crypto funds individually, it was seen that the majority of fund outflows were in Bitcoin.

While BTC experienced an outflow of $32.8 million last week, the largest altcoin Ethereum (ETH) saw an outflow of $4.3 million.

There were also outflows in the Bitcoin Short fund, which was indexed to the decline of BTC, and an outflow of $0.3 million was observed.

When we look at altcoins, we saw that there were generally inflows. At this point, Solana (SOL) experienced an inflow of $10.6 million, XRP $2.7 million and Cardano (ADA) an inflow of $3 million, while Litecoin (LTC) and Avalanche (AVAX) experienced an outflow of $0.1 million.

“While Bitcoin experienced outflows this week, altcoins bucked the trend by seeing inflows of $21 million.

Among the main beneficiaries of this trend, SOL experienced inflows of $10.6 million, Cardano $3 million, XRP $2.7 million, and Chainlink (LINK) $2 million.”

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an outflow of 18.3 million dollars.

After the USA, Germany ranked second with 9.7 million dollars; Sweden ranked third with 4.2 million dollars.

In response to these outflows, Canada experienced an inflow of 6.9 million dollars and Brazil experienced an inflow of 3.5 million dollars.

*This is not investment advice.