Following the tension between Iran and Israel over the weekend, there were sharp declines in Bitcoin and altcoins. While BTC dropped to $60,700, altcoins also experienced major losses.

While BTC and the market were slowly recovering after the sharp decline over the weekend, CoinShares published its weekly cryptocurrency report.

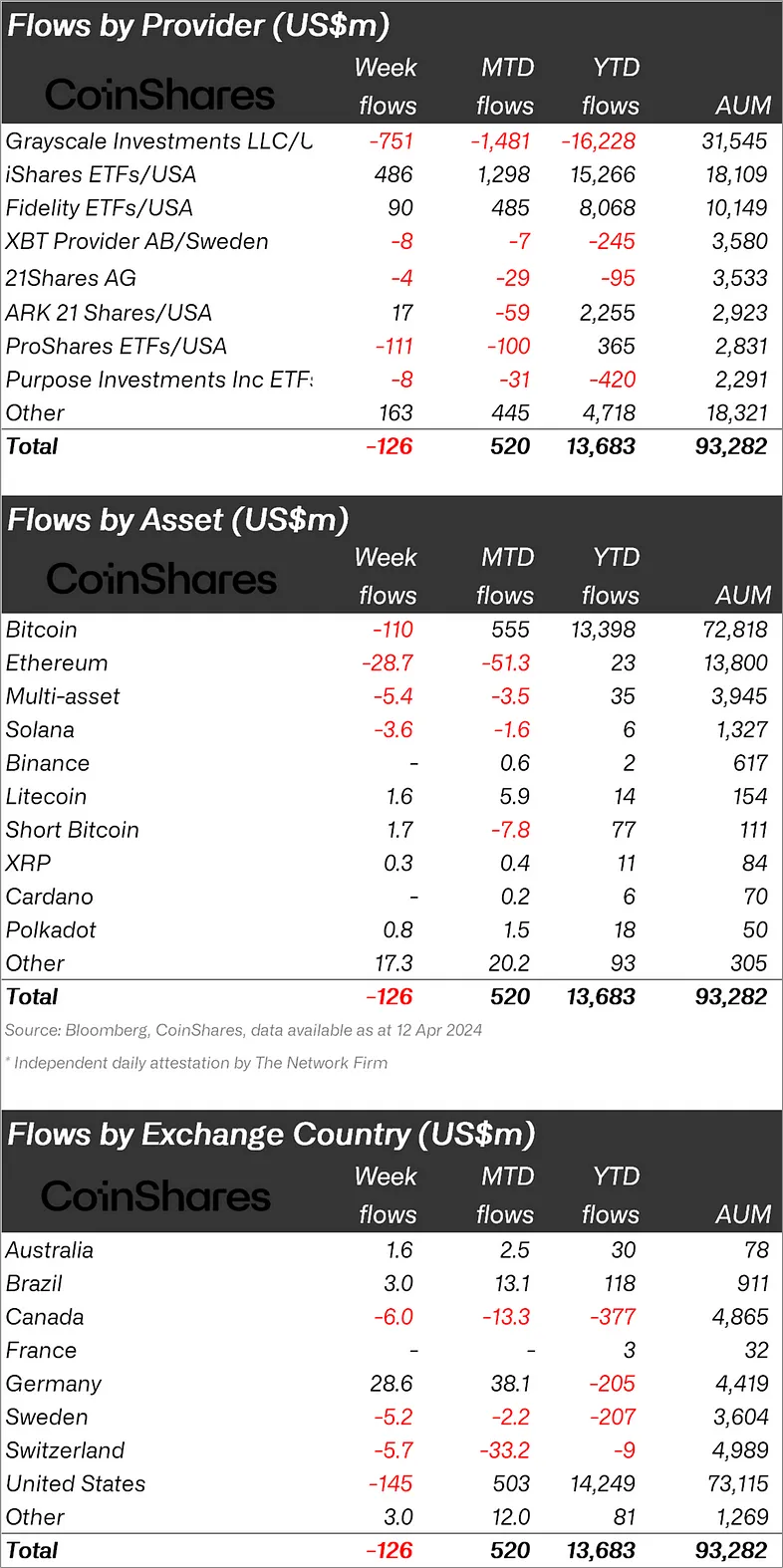

Stating that cryptocurrency investment products experienced small outflows of $126 million last week, Coinshares said that the positive price momentum has stopped.

“Cryptocurrency investment products saw small outflows of $126 million last week.

“Investors appear hesitant as positive price momentum has stalled.”

Ethereum (ETH) and Solana (SOL) Sales Continue!

When looking at crypto funds individually, it was seen that the majority of fund outflows were in Bitcoin.

While BTC experienced an outflow of $110 million, the largest altcoin Ethereum (ETH) also saw an outflow of $28.7 million.

There was an inflow of $1.7 million in the Bitcoin Short fund, which was indexed to the decline of BTC.

When we look at other altcoins, Litecoin (LTC) experienced an inflow of 1.6 million dollars, Polkadot (DOT) 0.8 million dollars, Decentraland (MANA) 4.9 million dollars, and LIDO 1.8 million dollars; Solana (SOL) experienced a $3.6 million outflow.

“Bitcoin saw outflows of $110 million but maintained positive inflows of $555 million since the beginning of the month. Short-bitcoin broke a 3-week outflow streak with small inflows of $1.7 million, likely taking advantage of recent price weakness.

Ethereum was the altcoin that suffered the most relative damage last week, with an outflow of $29 million, marking its 5th consecutive weekly outflow.

Aside from Solana seeing $3.6 million in outflows last week, altcoins had another good week. More esoteric names like Decentraland, Basic Attention Token, and LIDO saw inflows of $4.9 million, $2.9 million, and $1.8 million, respectively.”

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an outflow of 145 million dollars.

After the USA, Canada ranked second with 6 million dollars.

Against these outflows, Germany lost 28.6 million dollars; Brazil experienced an inflow of 3 million dollars.

*This is not investment advice.