While Bitcoin has maintained its position above $60,000 after the FED's 50 basis point interest rate cut decision, analysts now expect an increase in BTC.

While the BTC price moved sideways over the weekend, Coinshares released its weekly cryptocurrency report.

FED Effect on Bitcoin!

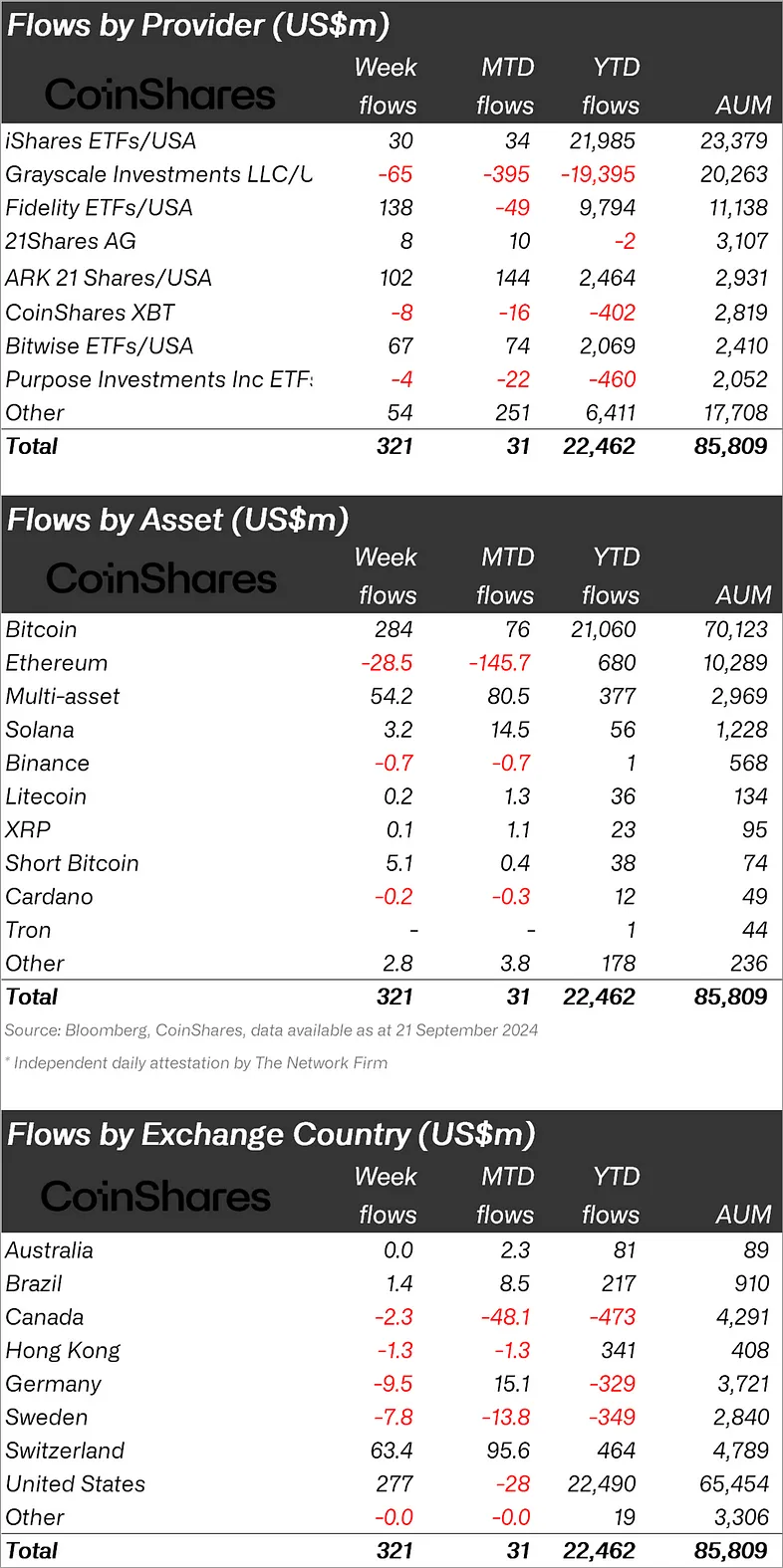

Coinshares stated that there was an inflow of $321 million into cryptocurrency investment products last week and that the FED was effective in this.

“Cryptocurrency investment products experienced inflows totaling $321 million for the second week in a row.

This increase was likely due to the Federal Open Market Committee's (FOMC) decision to cut interest rates by 50 basis points.”

Ethereum Continues to Exit!

When looking at crypto funds individually, it was seen that the majority of fund inflows were in Bitcoin.

While BTC experienced an inflow of $284 million, Ethereum (ETH) experienced an outflow of $28.5 million.

There was an outflow of $5.1 million in the Bitcoin Short fund, which was indexed to the fall of BTC.

When we look at other altcoins, Solana (SOL) saw an inflow of $3.2 million and Litecoin (LTC) saw an inflow of $0.2 million.

“Bitcoin was the main focus with $284 million inflows, but recent price action also led to a total of $5.1 million inflows into Short Bitcoin investment products.

Ethereum continues to see outflows, seeing outflows for the 5th week in a row, with a total outflow of $29 million last week. This is due to continued outflows from the existing Grayscale Trust and meager inflows from newly issued ETFs.

Meanwhile, Solana continues to see small but consistent weekly inflows, with inflows totaling $3.2 million last week.”

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an inflow of 277 million dollars.

Switzerland came in second after the United States with $63.4 million, and Brazil came in third with $1.4 million.

Against these inflows, Germany experienced an outflow of $9.5 million and Canada an outflow of $2.3 million.

*This is not investment advice.