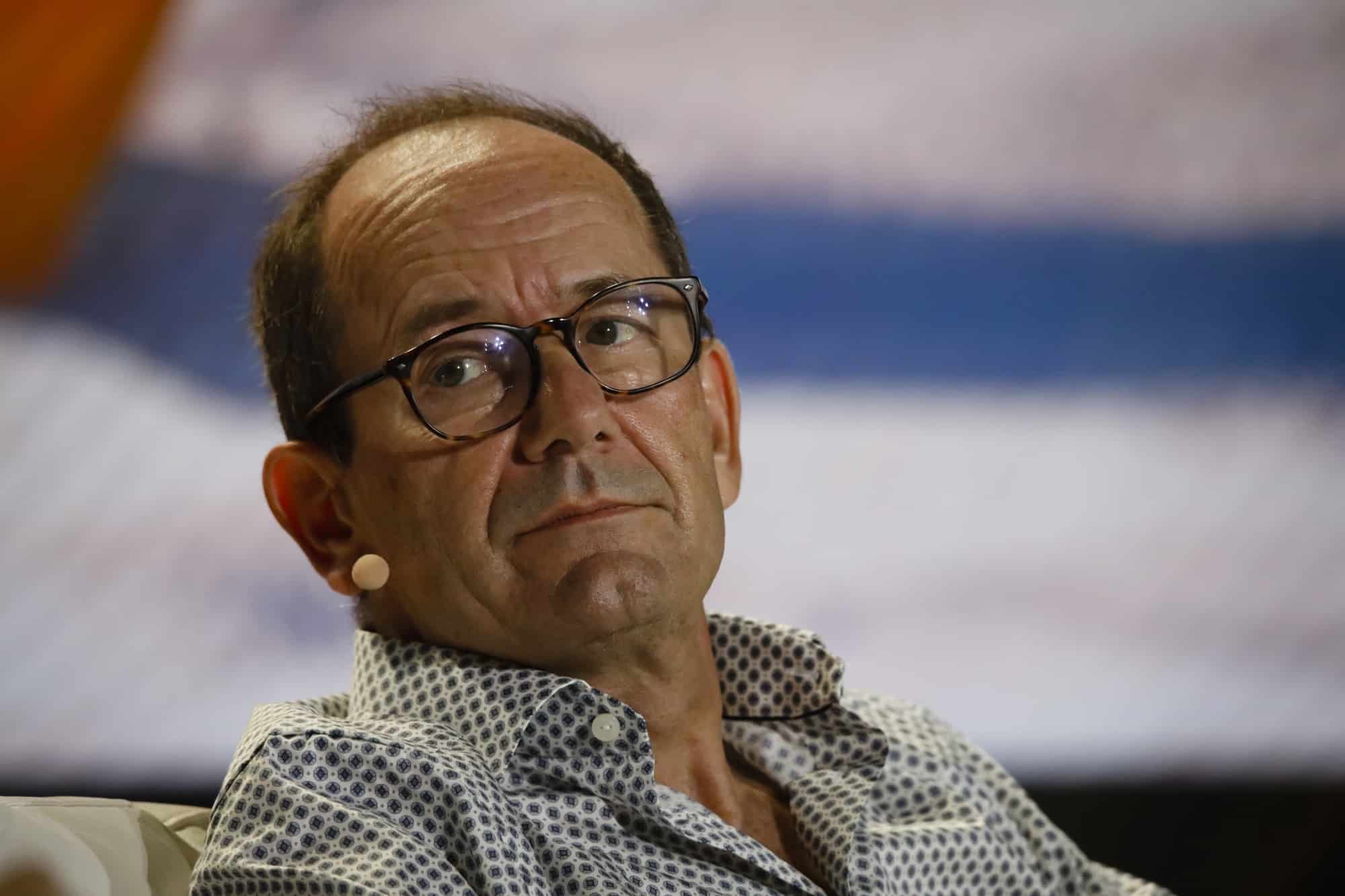

Marathon Digital Holdings CEO Fred Thiel shared his bullish outlook for Bitcoin and the overall cryptocurrency market on The Claman Countdown.

Thiel touted Bitcoin's long-term potential as a significant investment, advising people to allocate a small amount of funds to BTC each month.

“Put some money in Bitcoin every month and forget about it,” Thiel said, adding that consistent investments can grow significantly over a few years, citing Bitcoin’s historical performance of averaging annual returns of between 29% and 50% despite occasional downturns.

Bitcoin started 2025 with strong momentum, rising 3.25% to $97,605 as of January 1. Analysts and industry leaders, including Thiel, attribute the bullish trend to a more favorable regulatory environment under the Trump administration. Estimates for Bitcoin’s price range from $150,000 to $250,000 by the end of the year, driven by factors such as increasing institutional adoption and central banks potentially adding BTC to their reserves.

Thiel highlighted Marathon Digital’s strategic moves in this growing market. The company, the world’s largest Bitcoin miner, currently holds 44,893 Bitcoins worth over $4 billion and adds 700 to 900 new Bitcoins per month through mining.

The CEO also pointed to the transformative role of Bitcoin exchange-traded funds (ETFs), which currently collectively hold more than 1 million BTC. He noted that BlackRock CEO Larry Fink’s endorsement of Bitcoin as “digital gold” has boosted the asset’s credibility among investors.

Thiel also commented on broader developments, such as Switzerland's upcoming referendum on creating a national Bitcoin reserve and the growing interest of financial giants like Fidelity and E-Trade in crypto trading services.

Marathon Digital remains optimistic about Bitcoin’s future, with Thiel predicting continued growth due to limited supply, increasing demand, and broader acceptance among institutional and individual investors. “BTC doesn’t provide returns; it provides appreciation,” Thiel said, likening Bitcoin to gold as a store of value.

*This is not investment advice.