Although Coinbase's stock fell after the Securities and Exchange Commission (SEC) filed a lawsuit against cryptocurrency exchanges, it started to rise after the incoming ETF applications.

Veteran Investor Peter Brandt Expresses Concerns About Coinbase Global (COIN) Stocks

Brandt tweeted, “Heads and shoulders for Coinbase,” to highlight the bearish pattern.

Head and shoulders in $COIN pic.twitter.com/6jySM1P7XF

— Peter Brandt (@PeterLBrandt) July 6, 2023

The head and shoulders pattern consists of three peaks, with the middle peak being the highest (“head”) and the two outer peaks (“shoulders”) of nearly equal height.

The pattern forms on a baseline (“neckline”) and is widely considered one of the most reliable trend reversal patterns.

While the head and shoulders pattern indicates a potential price drop, it is important to note that this is not confirmed until the asset's price dips below the neckline.

In the case of Coinbase, the formation of this pattern could mean that the recent rally in company shares, backed in part by BlackRock's application for a Bitcoin exchange-traded fund (ETF), could be short-lived.

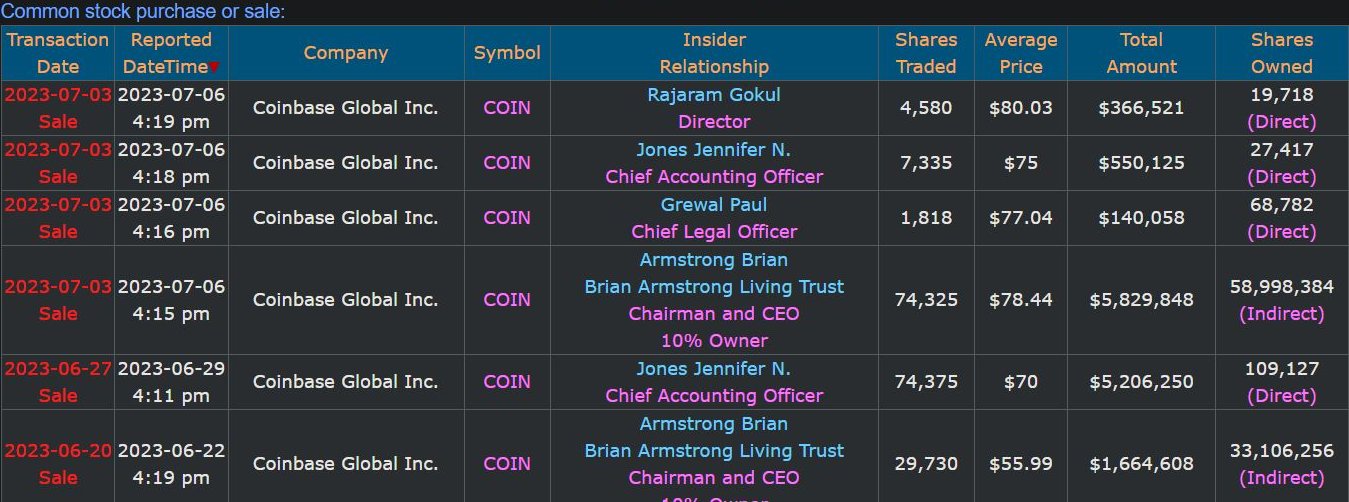

In addition, the fact that Coinbase CEO and senior executives sold a total of 6 million 886 thousand 552 shares of company shares on July 6 appears to support Peter Brandt.

Coinbase shares have risen over 30% since June 15, when BlackRock applied for an ETF using Coinbase as a custodian. However, the emergence of a head and shoulders pattern indicates a potential price drop.

Although head and shoulder formation is considered a reliable indicator, its accuracy is not guaranteed.

*Not investment advice.