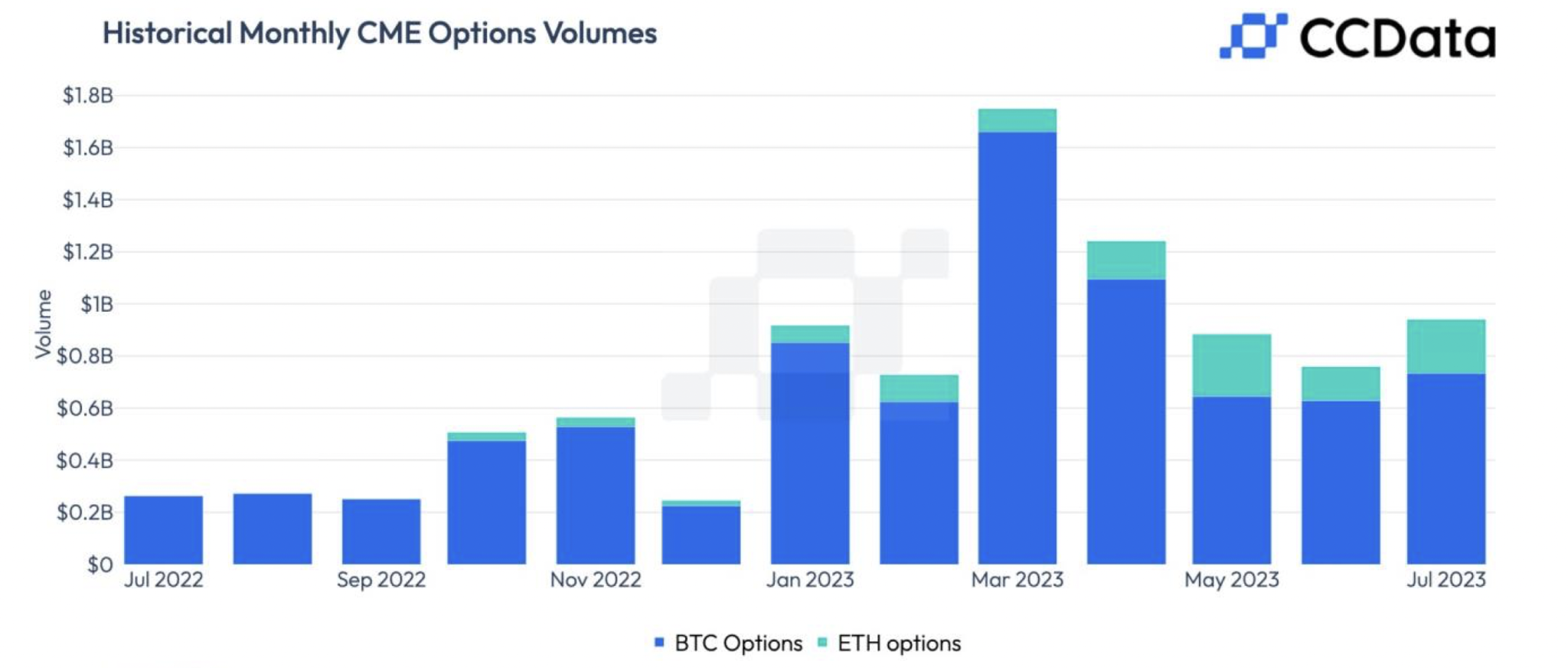

Crypto options trading volume on the Chicago Mercantile Exchange (CME) experienced significant growth in July, reaching nearly $1 billion.

Bitcoin's Transaction Volume on CME Rises

This increase in trading activity marks the first increase in four months and is driven by increased investor interest in hedging instruments.

Notably, CME's BTC options volume rose 16.6% to $734 million, while ETH options rose a staggering 60% to $207 million.

Options are derivative contracts that give the buyer the right to buy or sell the underlying asset at a predetermined price on or before a certain date.

In the CME example, options give buyers the right to buy or sell a cryptocurrency futures contract at a predetermined price at a future date.

Both Bitcoin and Ethereum fell 4% in July due to growth in options trading, waning optimism surrounding the potential launch of the Bitcoin Spot ETF, regulatory uncertainties, and DeFi hacks affecting market sentiment.

As Bitcoin's correlation with traditional assets such as stocks and gold has increased, options have become more attractive to investors to hedge directional risk in the crypto market.

Despite the growth in options trading, overall activity in CME's BTC and ETH futures has cooled somewhat in line with the global slowdown.

Futures trading volume on the CME fell 17.6% to $39.1 billion, while total derivatives trading volume (including futures and options) fell 17.0% to $40.1 billion.

The combined trading volume of both centralized crypto spot and derivatives exchanges also fell 12% in July to $2.36 trillion.

*Not investment advice.