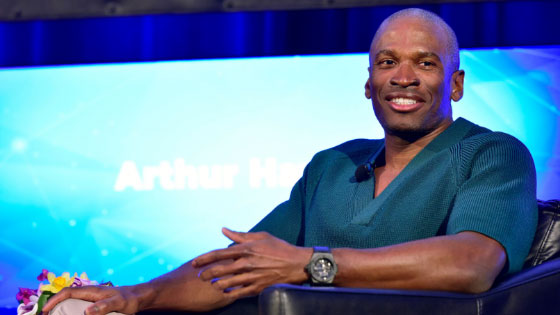

Former BitMEX CEO Arthur Hayes, who attracted attention with his analyses of Bitcoin (BTC) and the cryptocurrency market, explained his bullish predictions about Ethereum and some altcoins in his latest statements.

Hayes, who based his bullish forecasts on the FED's interest rate cuts, said he expects a new ETH bull run if US Treasury rates fall below 4%.

Speaking about the FED interest rate cuts, Hayes said that the interest rate cut could increase inflation and collapse the markets by strengthening the Japanese yen.

The Fed is expected to announce its first interest rate cut since 2020 later today. This is expected to kick off an easing cycle that has historically been seen as a good sign for Bitcoin (BTC).

However, Hayes argued that the upcoming rate cut would exacerbate the inflation problem and lead to a strengthening of the yen (JPY), causing a broad-based risk aversion trend and risk assets including cryptocurrencies could crash within days of the first rate cut.

Hayes pointed out that the only thing that matters in the short term is the USD/JPY pair, citing the early August decline as an example.

A New Ethereum Bullish May Begin!

Speaking at the Token2049 conference in Singapore, BitMEX co-founder Arthur Hayes predicted that a new ETH bull run would begin as the Fed’s interest rate cuts push US Treasury rates below 4%, JinSe Finance reported.

Stating that ETH is a type of internet bond that offers a staking yield of approximately 4%, Hayes stated that as the FED lowers interest rates, altcoins such as ENA, ETHFI and PENDLE, other than Ethereum, will rise and surpass the US Treasury yield in terms of profit.

According to Hayes, near-zero interest rates mean investors may start looking for yield elsewhere again, which could reignite a bull run in yield-generating areas of the cryptocurrency market (Ether, Ethena’s USDe and Pendle’s BTC staking).

Finally, Hayes added that as Fed rate cuts come, real world asset (RWA) tokens like ONDO will be the losers.

*This is not investment advice.