As Bitcoin tries to hold $26800, uncertainties about the future continue to confuse investors.

While the lack of illiquidity in the crypto money markets discourages investors, the fact that the Bitcoin Halving is less than a year causes hopes to bloom.

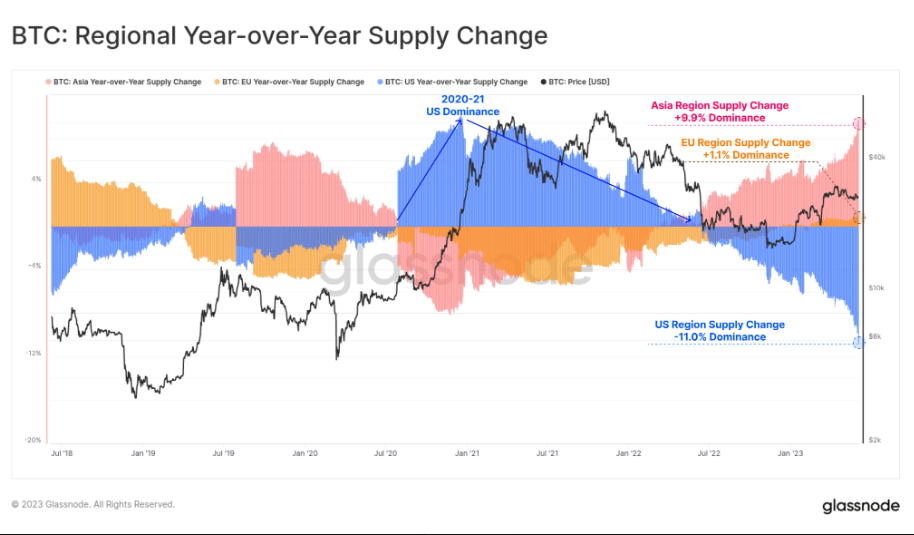

While investors are trying to find the direction of Bitcoin, an important data on the change in Bitcoin supply dominance came from Glassnode.

Accordingly, the dominance over Bitcoin supply has undergone a serious change in the last 2 years.

While the supply of Bitcoin in the hands of institutions in the USA decreased, the dominance of Bitcoin in the Asian side increased at the same rate.

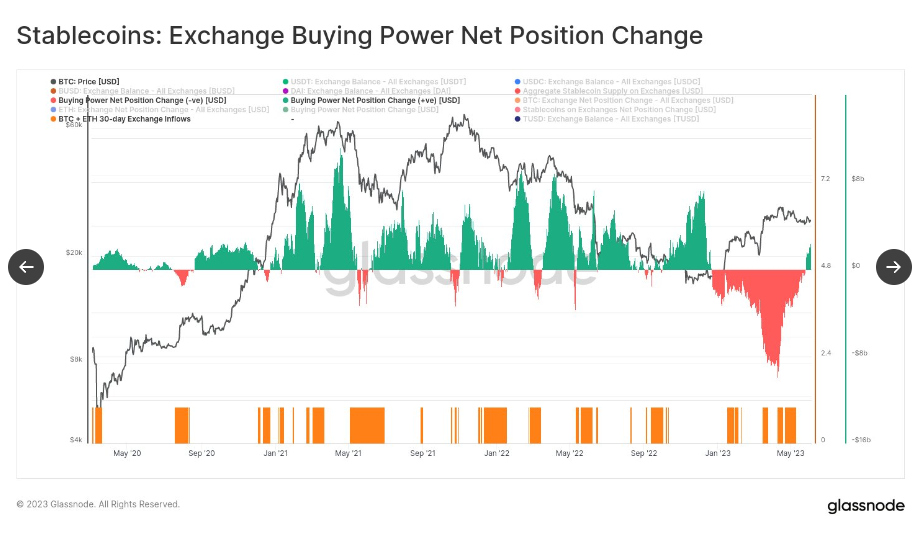

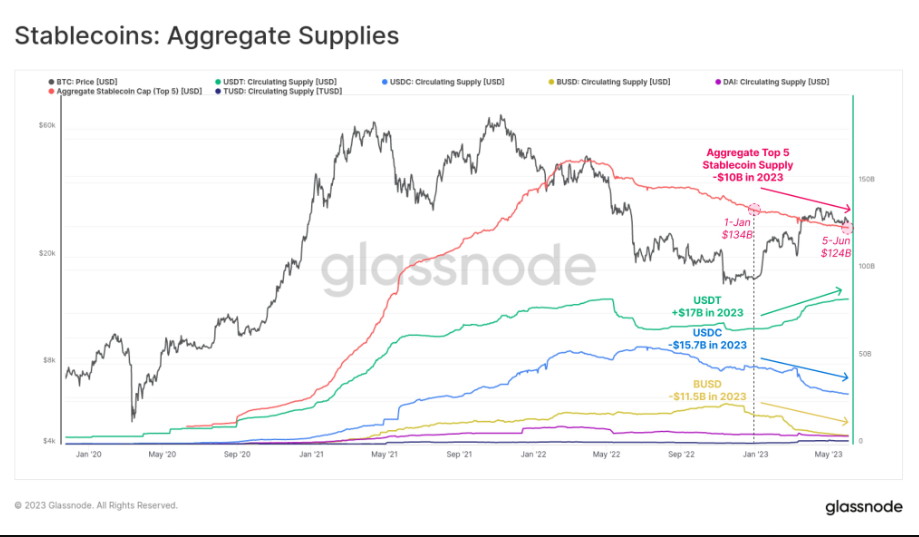

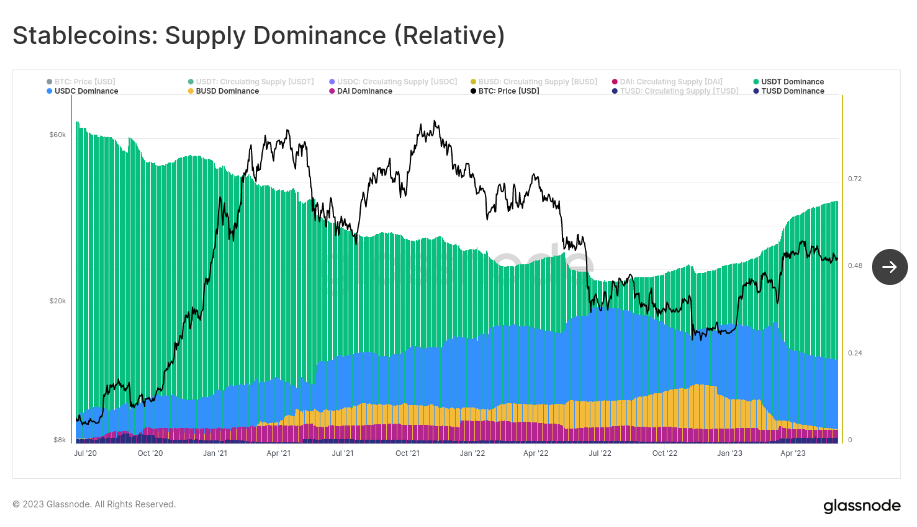

It was also stated that the US dominance over stablecoins has decreased. Blocking interest rates and increasing regulatory pressures in the US are the biggest barriers to the entry of US capital into stablecoins, which is reflected in the charts.

According to Glassnode, this illiquidity and uncertainties lead investors to less risky cryptocurrencies and money shifts to them.

“The dominance over the bitcoin supply has changed quite dramatically over the past two years.

While US institutions held 11% less BTC compared to June 2022, the dominance of Bitcoin in the hands of investors active during trading hours in Asia increased by 9.9%.

This marks a marked reversal from the 2020-2021 bull cycle.

USDT hit new ATH while USDC and BUSD fell to their lows. This shows that change is continuing.

We see that US capital is less active on digital assets, given that stable currencies are not interest-bearing and regulatory pressure in the US is increasing.

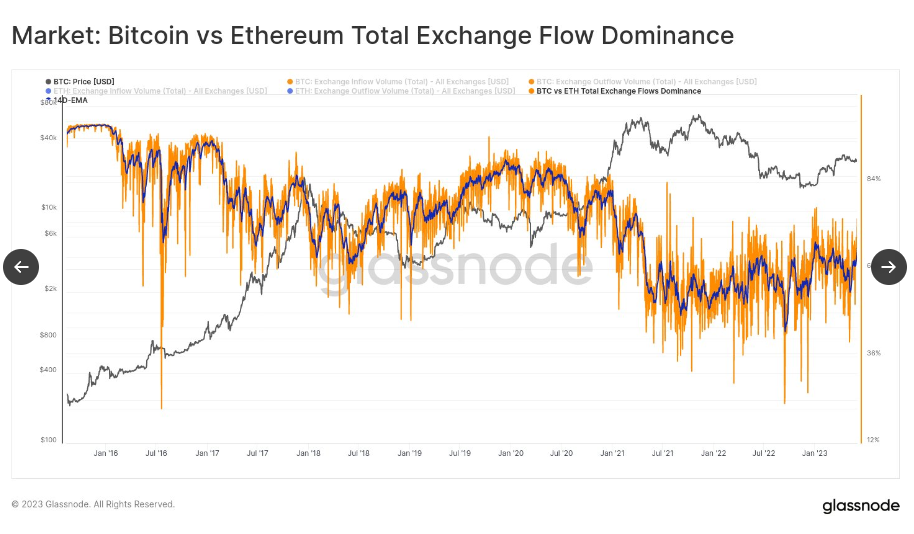

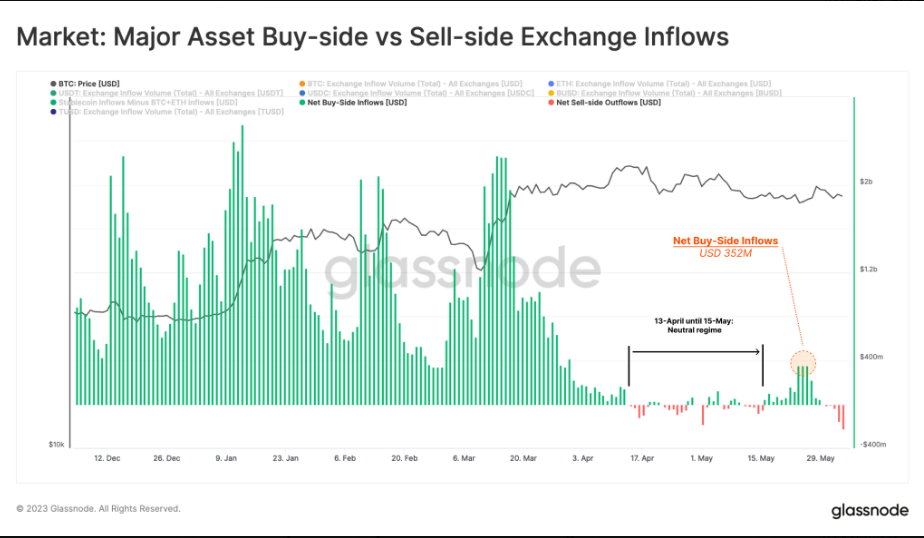

If we look at the on-chain exchange flows, we have seen quite weak demand since April.

Stablecoin inflows in the first quarter largely offset BTC+ETH inflows. However, we see that after the correction, BTC and ETH entries are more than stablecoin entries. This means selling pressure.

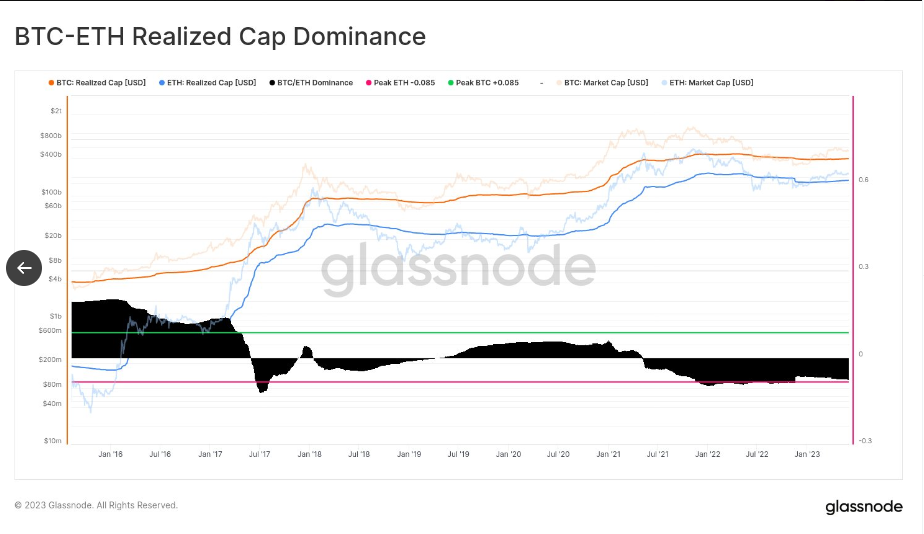

There are some metrics showing that liquidity is moving towards lower-risk assets within cryptocurrencies as well, with a clear capital rotation.