ARK Invest CEO Cathie Wood made a bold statement, suggesting that Bitcoin (BTC) is replacing gold as a store of value asset.

Wood shared his belief that Bitcoin acts more as a risk-off asset and a “flight to quality” during times of economic uncertainty.

“Last year, during the regional bank crisis in March, Bitcoin rose 40% while the GCI, the regional bank index, collapsed.

Here too the regional bank index is on the move and we see Bitcoin making a resurgence after some correction following the introduction of the 11 ETFs,” Wood explained.

Wood also noted that the decline in Bitcoin's value following the launch of the ETFs was due to anticipated buying before the ETFs were launched. This was followed by a selling reaction from opportunistic investors upon the news.

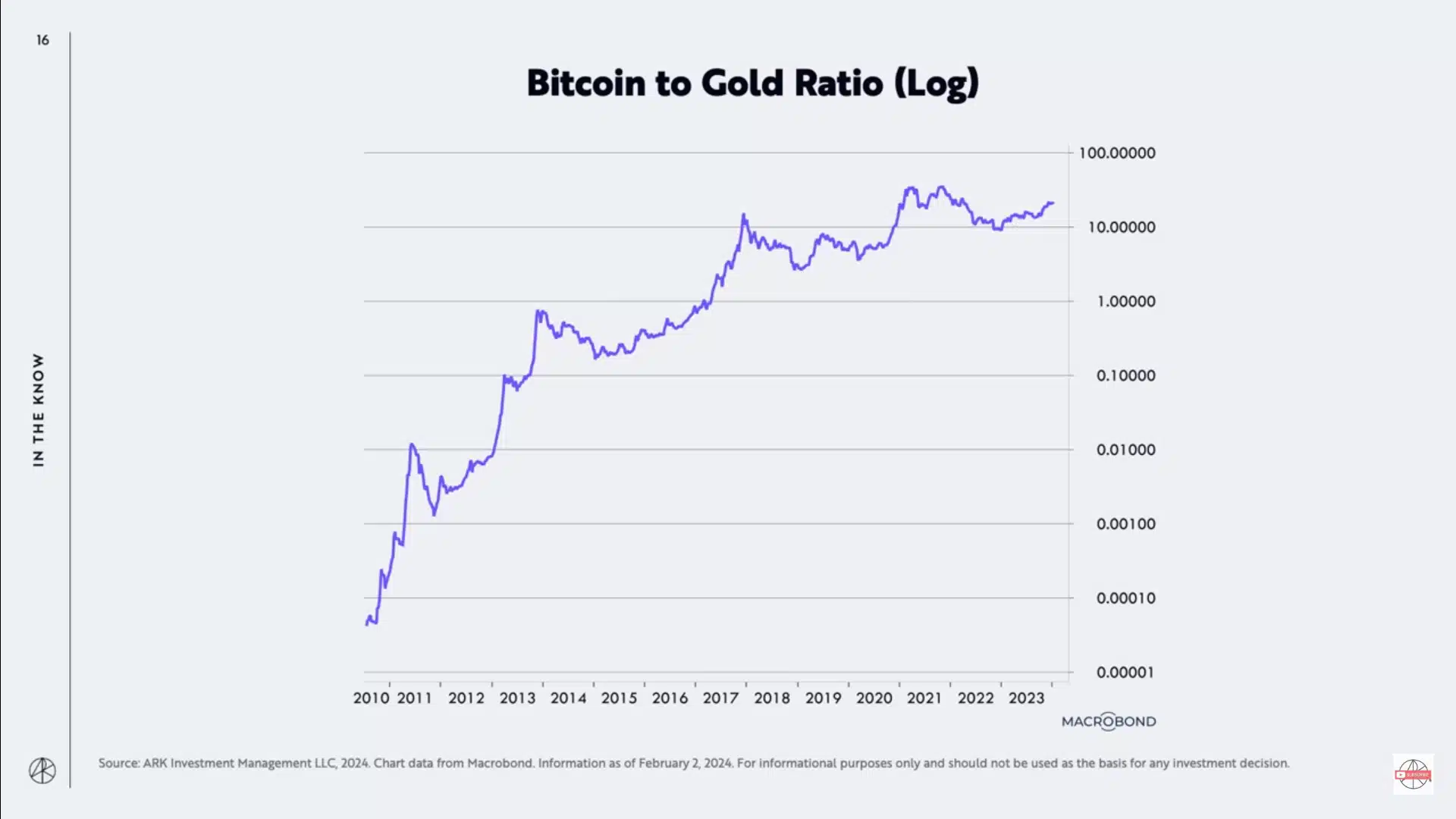

Wood shared a chart where Bitcoin is priced with gold, showing a strong, long-term uptrend. He interpreted this as an indication that BTC is in the process of partially replacing the yellow metal.

“This chart shows you that Bitcoin is rising relative to gold. There's a shift towards Bitcoin now, and we think that's going to continue because there's a much easier way, a less cumbersome way to access Bitcoin,” he said.

As Bitcoin continues to strengthen its position in the financial market, Wood's views offer an interesting perspective on the evolving dynamics between traditional and digital assets.

*This is not investment advice.