Cryptocurrency prices, especially Bitcoin, have fallen significantly today, creating panic among investors. Panic sales have intensified due to global developments, macroeconomic events, and technical weakness in cryptocurrencies.

At this point, the Bitcoin price dropped to $ 58,000, while Ethereum fell to $ 2,540.

While the altcoin market also turned red in the last 24 hours, Tether Gold (XAUt) was the only gainer.

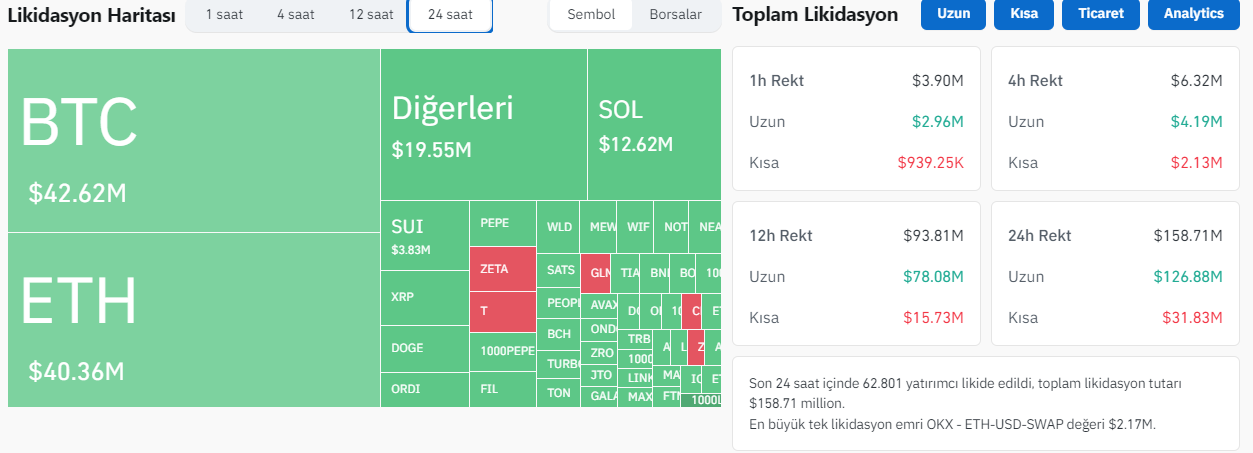

This market decline has caused a large number of long positions to be liquidated. According to CoinGlass data, $158.7 million worth of leveraged transactions were liquidated in the last 24 hours. $126.8 million of these were long positions and $31.8 million were short positions.

While 62,800 investors liquidated in the last 24 hours, the largest single liquidation order was placed on OKX on the ETH/USD trading pair.

The largest liquidation was in Bitcoin, followed by Ethereum and Solana (SOL).

Bitcoin Could Drop to $56,800!

While this sudden drop in Bitcoin has made investors nervous, cryptocurrency data provider CoinGlass analyzed that BTC will test the $56.8 thousand support level.

According to the CoinGlass BTC Liquidity/Order Book Heatmap, he noted that BTC will test the 56,800 support level first.

According to CoinGlass, if the bounce at this level is strong, BTC will test higher levels.

However, if the bounce here is weak, Bitcoin may fall to lower price levels.

“BTC Liquidity / Order Book Heat Map

“First test is $56,800, if the bounce is strong we will test higher levels. If the bounce is weak we will move to lower price levels.”

Bitcoin, which has fallen by 4.8% in the last 24 hours, continues to be traded at $57,960 at the time of writing.

#BTC Liquidity / Orderbook Heatmap

First test $56800, if the bounce is strong, we will test higher levels. If the bounce is weak, we will go to lower price levels.

👉https://t.co/z9WYoWqeVP pic.twitter.com/S72yJNag7v

— CoinGlass (@coinglass_com) August 12, 2024

*This is not investment advice.