Binance, the world's largest cryptocurrency exchange, announced the proof-of-reserve system to regain the decreasing trust in Bitcoin exchanges after the sudden bankruptcy of FTX.

In this context, Binance, which publishes reserve reports at regular intervals, has published the 25th Report (snapshot date December 1) of its reserves.

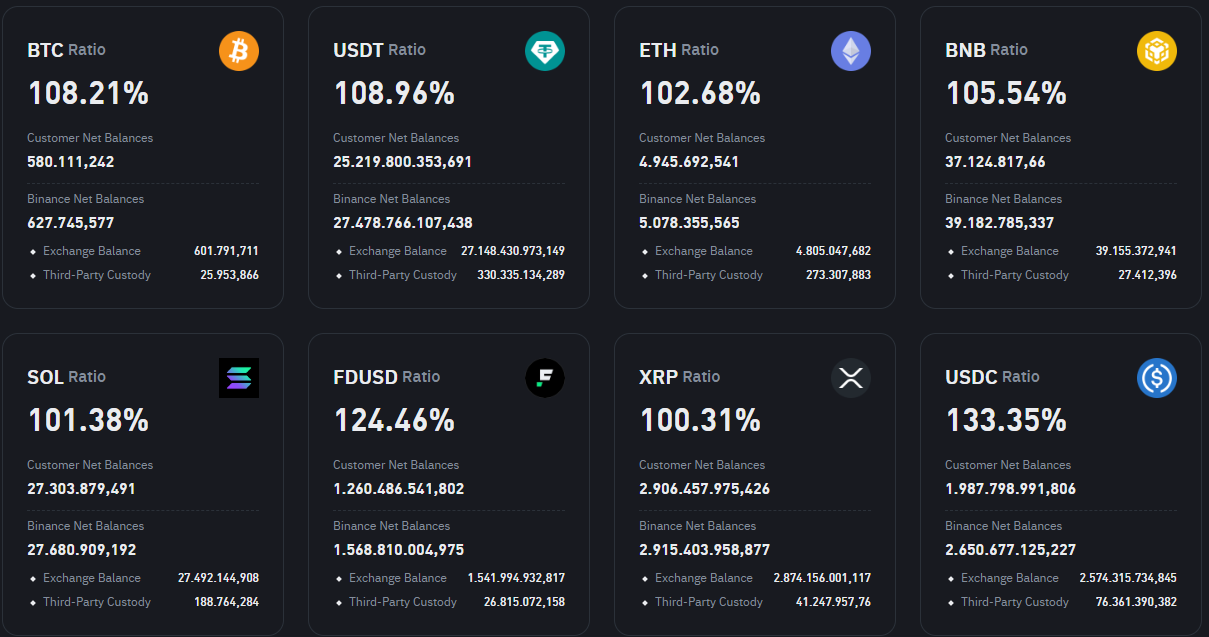

Apart from Bitcoin (BTC), the report includes USDT, Ethereum (ETH), BNB, Solana (SOL), FDUSD, XRP, USDC, TUSD, Dogecoin (DOGE), Polygon (MATIC), Polkadot (DOT), Chainlink (LINK), SHIB, Arbitrum (ARB), Litecoin (LTC), Optimisim (OP), Chilliz (CHZ), UNI, Aptos (APT), GRT, SSV, CHR, ENJ, 1INCH, CRV, WRX, MASK, HFT, BUSD and CVP and BOME, Pepecoin (PEPE) and WIF were featured.

Accordingly, users' Bitcoin assets decreased by 4.68% compared to the previous report, falling to 580,111 BTC; while USDT assets increased by 20.93%, reaching 25.21 billion.

It was also seen that users' BNB assets decreased by 2.15% to 37.12 million.

Finally, when looking at users' Ethereum assets, it was seen that it increased by 5.24% to 4.94 million.

Binance’s latest proof of reserves shows that despite the dwindling assets, BTC, USDT, and ETH reserves remain overcollateralized by 108.21%, 108.96%, and 102.68%, respectively.

*This is not investment advice.