Strategy (MicroStrategy), which usually makes regular weekly Bitcoin purchases, skipped this week. In other words, Strategy did not make any Bitcoin (BTC) purchases last week.

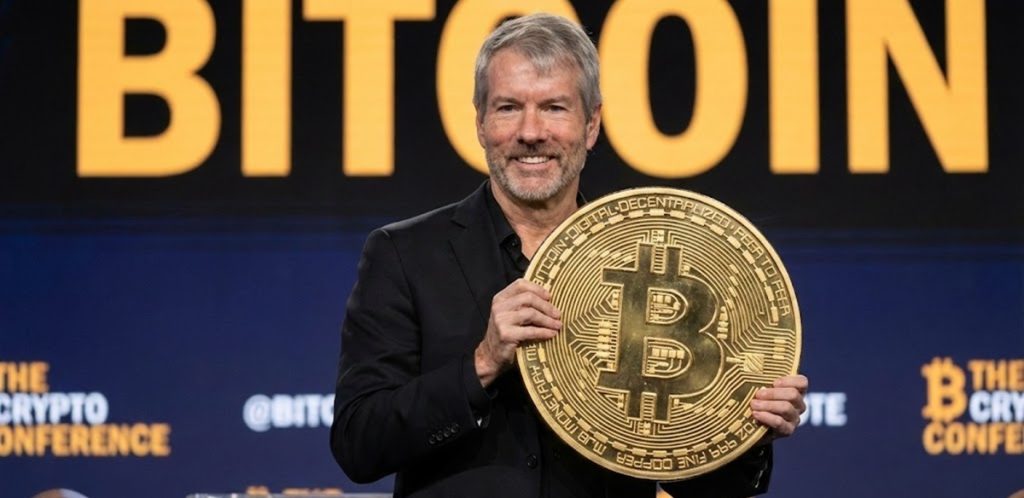

Strategy founder Michael Saylor announced the news via a post on his X account. Michael Saylor stated that the company’s dollar liquidity has been further expanded.

Saylor stated that Strategy increased its USD reserves by $748 million, adding that the company currently has $2.19 billion in cash.

Saylor also added that the company owns 671,268,671,268 Bitcoin.

“Strategy has increased its US dollar reserves by $748 million, bringing the current total to $2.19 billion. It also owns 671,268 Bitcoin.”

Strategy announced last week that it had purchased 10,645 BTC worth $980.3 million between December 8 and December 14 at an average price of $92,098.

However, this week Strategy increased its dollar reserves instead of buying Bitcoin. This suggests Strategy is turning to cash reserves to back up its MSCI index.

As is known, index provider MSCI is considering removing Strategy and many other companies with cryptocurrencies like Bitcoin on their balance sheets from its main stock indices. To this end, MSCI began discussions in October regarding a delisting proposal for companies whose balance sheets consist largely of crypto assets. MSCI’s final decision is expected on January 15, 2026.

In this context, Strategy, which is under investigation, aims to increase its credibility by strengthening its cash reserves.

*This is not investment advice.