Bitcoin (BTC) price has been below $30,000 for a long time, and it appears to be having difficulty breaking through this hurdle.

However, crypto analyst Ali Martinez emphasized a remarkable point in his post on X. According to the analyst, there were sudden volume increases in the buying direction on BitMEX, a derivatives commodity exchange.

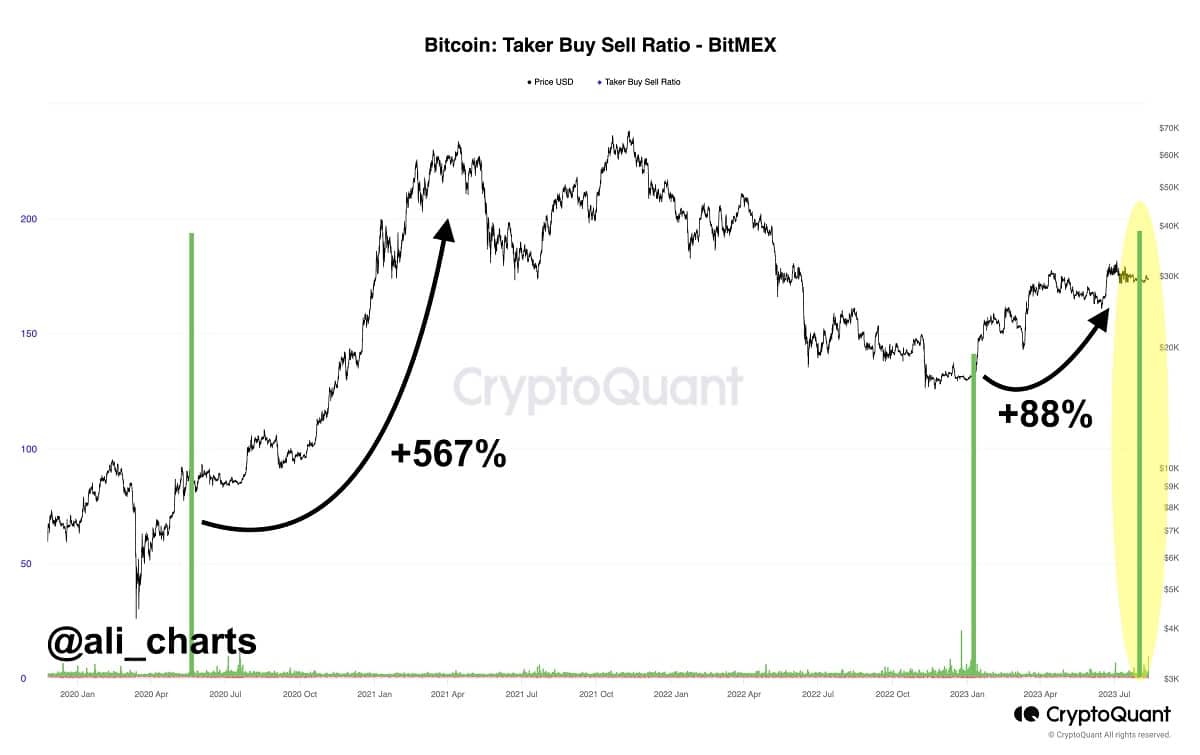

Sharing his findings, Ali Martinez stated that there is a positive correlation between the buyer buy-sell rate on BitMEX and the price of Bitcoin.

Martinez said that large increases in the buyer-exchange rate on BitMEX are rare, but when they do happen they often precede significant increases for Bitcoin. For example, in May 2020, the buyer-to-sell ratio rose to 192, resulting in a 567% price increase for Bitcoin in the months that followed. In January 2023, the buyers' buy-sell ratio increased to 140, causing Bitcoin to experience an 88% price increase in the following weeks.

The most recent increase in the buyer buy-sell rate on BitMEX came with its rise to 194. The analyst claimed that if history repeats itself, this could be the start of a new bull run.

The most recent increase in the buyer buy-sell rate on BitMEX came with its rise to 194. The analyst claimed that if history repeats itself, this could be the start of a new bull run.

*Not investment advice.