While Bitcoin continues its struggle for $ 30,000, the Fed's interest rate decision is expected this week in BTC and altcoins.

At this point, CoinShares, which published its weekly crypto money report, said that the four-week fund inflow was replaced by the exit this week.

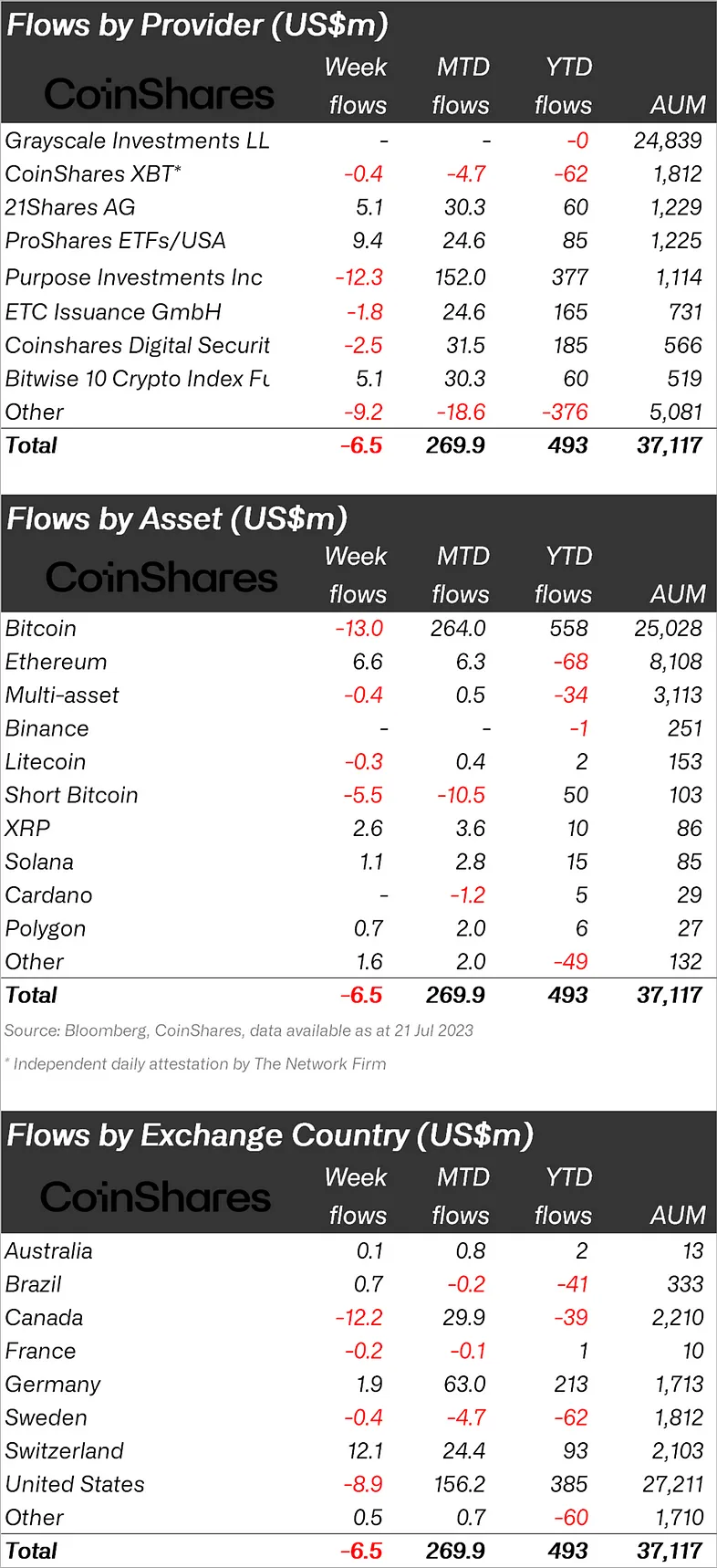

“Cryptocurrency investment products saw small outflows totaling $6.5 million last week, after inflows of $742 million in the previous 4 weeks.”

Looking at crypto funds individually, it was seen that the majority of fund outflows were in Bitcoin.

While BTC experienced an outflow of $ 13 million last week, the largest altcoin Ethereum (ETH) saw an inflow of $ 6.6 million.

There was an outflow of $ 5.5 million in the Bitcoin Short fund, which was indexed to the fall of BTC.

“Bitcoin was again the primary focus, as it has been in the past weeks.

While BTC saw an outflow of $ 13 million, the Bitcoin short fund also saw a total outflow of $ 5.5 million in the 13th week in a row.

Ethereum topped the leaderboard last week, seeing $6.6 million in entries, indicating that the weak mood for ETH in 2023 is slowly starting to reverse.”

While Bitcoin is experiencing an exit, the entrance to Ethereum shows that there is an altcoin season expectation in which altcoins will appreciate against Bitcoin in the upcoming period.

Looking at other altcoins, Solana (SOL) entered $1.1 million, XRP $2.6 million, Polygon (MATIC) $0.7 million.

Against these entries, Litecoin (LTC) broke out of $ 0.3 million.

Looking at the regional fund inflows and outflows, it was seen that Canada ranked first with an outflow of 12.2 million dollars.

After Canada, the USA ranks second with 8.9 million dollars; Sweden took the third place with 0.4 million dollars.

Against these exits, Switzerland is $12.1 million; Germany $1.9 million; Brazil, on the other hand, had an inflow of 0.7 million dollars.