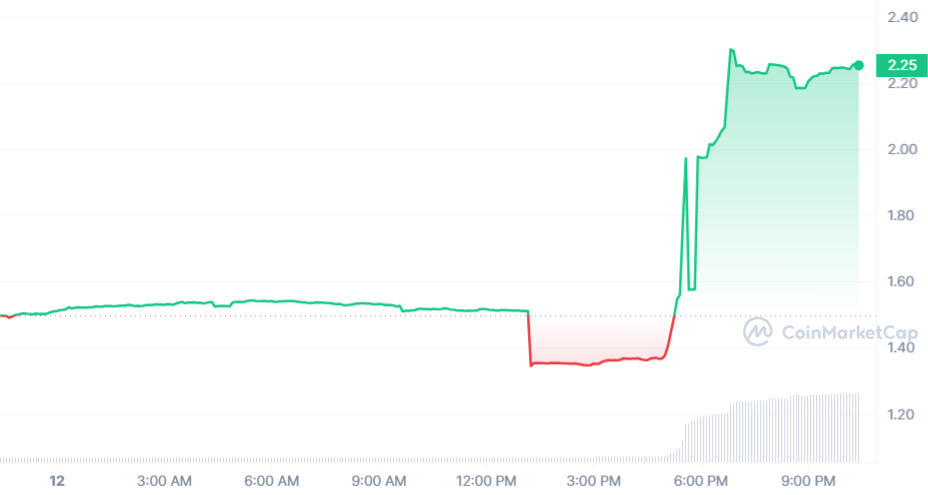

Decentralized finance (DeFi) protocol Conic Finance came to the fore as governance token CNC rose nearly 50% to $2.20 following the announcement of its comeback plans.

The protocol suffered a significant setback when it was hacked in July and suffered a loss of approximately $3.6 million worth of ETH. Since then, Conic Finance has been working to rectify the situation and regain its position in the DeFi space.

“Conic has undergone an extensive audit and review over the past four months in preparation for v2 deployment,” a recent management post said. The protocol is now being prepared for launch, with all audits nearing completion, according to the developers.

Conic Finance enables liquidity providers to diversify their exposure to multiple liquidity pools and generate returns through major DeFi cryptocurrency platform Curve Finance, called Omnipools.

According to the published post, within two days it will hold a vote on the list of supported Omnipool assets, whitelisted Curve pools and initial liquidity allocation weights for each Omnipool. Once the votes are concluded, a separate management proposal regarding v2 release distribution will include new features, reimbursement plans, and incentives.

This fallback plan follows a hacker attack on the protocol in July that exploited a “read-only reentrancy” bug that pulled approximately 1,700 ETH from Conic’s ETH Omnipool, worth over $3.6 million at the time.

Total value locked (TVL) on Conic was around $150 million before the attack, but recently dropped below $1 million, according to DefiLlama data.

*This is not investment advice.