This week is of great importance for Bitcoin (BTC) and the cryptocurrency market. Because all eyes are on the interest rate decision of the US Federal Reserve (FED) after the announcement of May's CPI and PPI data.

Although BTC rose above $71,000 last week, it fell sharply after the US Nonfarm Payload data on Friday and fell to $69,000.

Many analysts believe that although the Bank of Canada and the European Central Bank have cut interest rates, the likelihood of the US Federal Reserve moving in a similar direction is low.

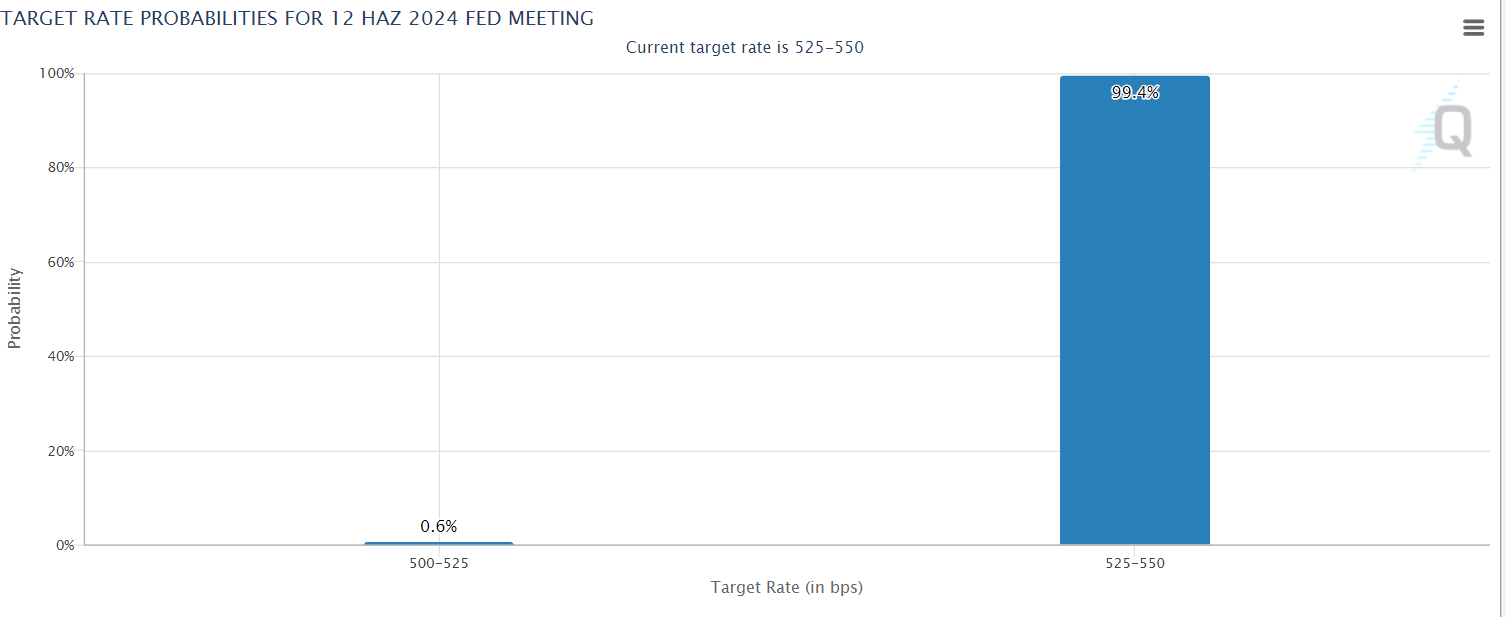

According to the CME Group FedWatch Tool, while interest rates are priced to remain constant at 99.4%, investors expect the earliest possible interest rate cut to occur in September.

What is important here is what kind of speech FED Chairman Jerome Powell will make rather than the FED's interest rate decision.

Analysts predict that Bitcoin will rise if Powell gives positive messages about inflation and interest rate cuts.

Expectation of 89 Thousand Dollars for Bitcoin!

Prominent cryptocurrency analyst Ali Martinez predicted a significant potential increase in Bitcoin's value, predicting a rise to the $89,200 level.

Using the rising Bitcoin Buyer Buying Selling Ratio in this prediction, the analyst pointed out that BTC purchases have increased.

The analyst predicts that this significant buying pressure in BTC may cause the Bitcoin price to experience a strong upward movement in the near future and reach as high as $89,200.

The next potential local top for #Bitcoin could be around $89,200! pic.twitter.com/dVKmFwKnh4

— Ali (@ali_charts) June 9, 2024

*This is not investment advice.