While Bitcoin and altcoins start the week in red, BTC shows sudden movements. At this point, while BTC dropped to $ 54,000 in the morning hours, it rose again to $ 57,000 in the last hours.

Is there a rise or fall next in the BTC and cryptocurrency markets? While the question was wondered, Coinshares published its weekly cryptocurrency report.

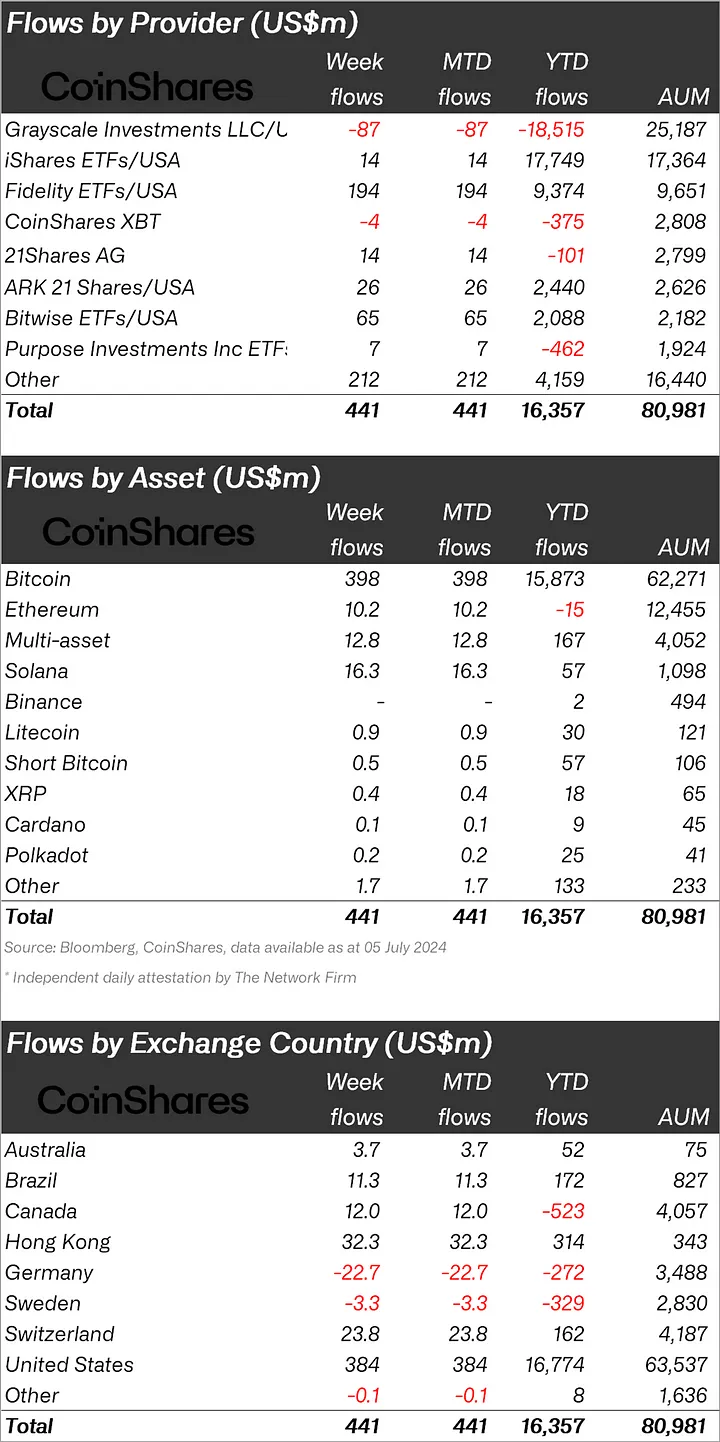

Stating that there was an inflow of $441 million in cryptocurrency investment products last week, Coinshares said that the declines are expected to be seen as a buying opportunity.

“While a total of $441 million inflow was recorded in cryptocurrency investment products last week, Mt. “The recent price weakness due to selling pressure from Gox and the German Government is likely to be seen as a buying opportunity.”

Bitcoin (BTC) and Solana (SOL) in Focus!

When looking at crypto funds individually, it was seen that the majority of fund inflows were in Bitcoin.

While BTC experienced an inflow of $398 million, the largest altcoin Ethereum (ETH) experienced an inflow of $10.2 million.

When we look at other altcoins, Solana (SOL) experienced an inflow of $16.3 million, Litecoin (LTC) $0.9 million and XRP $0.4 million.

“Bitcoin saw inflows of $398 million but unusually represented only 90% of total inflows as investors chose to invest in a much larger altcoin.

The most notable of these was Solana, which saw $16 million in inflows last week. This increased year-to-date inflows to $57 million, making it the best-performing altcoin in terms of flows.

Ethereum sentiment appears to have changed and is seeing $10 million inflows, but remains the only altcoin to see net outflows year-to-date.”

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an inflow of 384 million dollars.

After the USA, Hong Kong ranks second with 32.3 million dollars; Switzerland ranked third with 23.8 million dollars.

Against these inflows, Germany experienced an outflow of 22.7 million dollars.

*This is not investment advice.