Blast, a layer-2 blockchain set to launch in March, has attracted over $225 million in staked Ethereum (stETH) and stablecoins since Monday.

Layer-2 networks are built on top of layer-1 blockchains such as Ethereum to make transactions faster and cheaper. Blast had announced plans to earn returns through Ethereum (ETH) staking and real-world assets (RWAs).

According to the platform, most of the $225 million raised by Blast was staked on the liquid staking protocol Lido, making Blast the seventh largest holder of stETH.

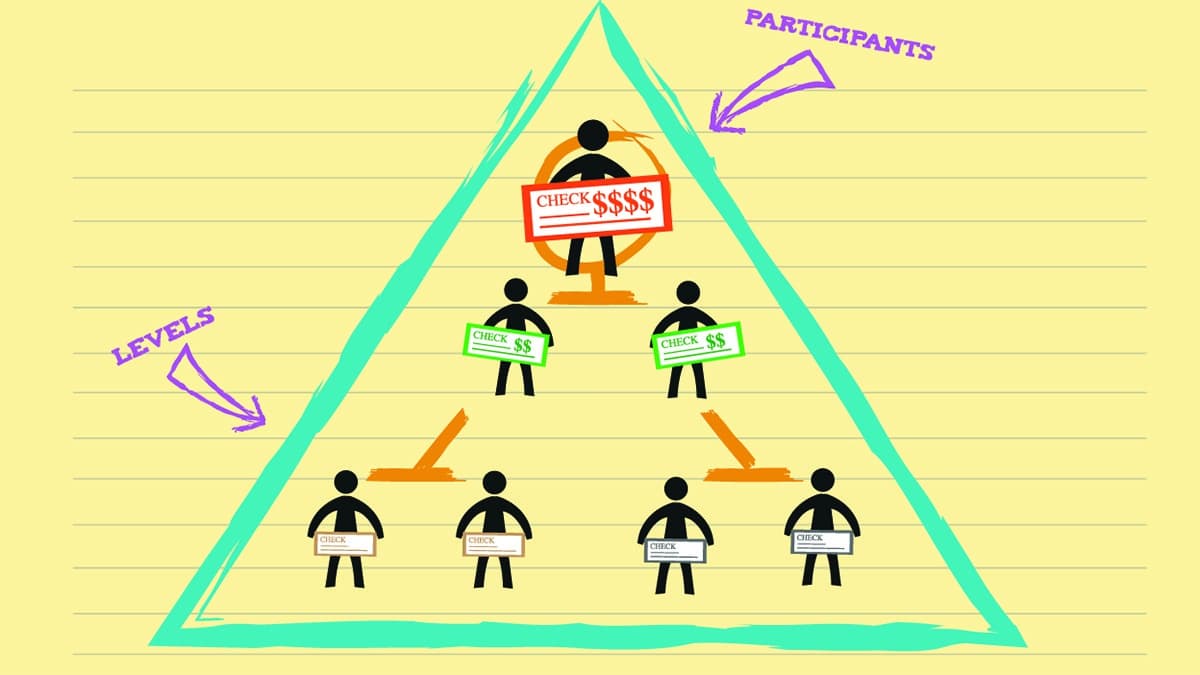

Despite its popularity, Blast has faced skepticism from many crypto investors. Some observers have likened Blast points to a pyramid scheme, where early users are eligible to earn more points based on the number of users they bring in. The technical documentation shows that users receive 16% additional points when the users they invite bring more participants, and 8% additional points when the second level brings more people.

In response to these allegations, the platform's founder PacmanBlur said:

“Blast's return to users may feel too good to be true, so the jokes are understandable. But simply put, Blast's return comes (initially) from Lido and MakerDAO.”

He also explained that these returns are not unsustainable and are a key component of the on-chain and off-chain economy.

He also clarified that Paradigm had no involvement in the launch of Blast and that Blast's invite system is not a new mechanism. He emphasized that Blast would be nothing without its community and that their goal is to grow the on-chain economy with the highest yielding L2 possible.

However, it is important to be careful, especially when it comes to “too good to be true” returns in the cryptocurrency market. In the past, the dollar-linked stablecoin UST promised gains of over 20%, and with the collapse of the system, the value of all USTs was almost zero.

*This is not investment advice.