As the leading cryptocurrency Bitcoin rises above $ 35,000 again, a positive atmosphere continues to prevail in the market.

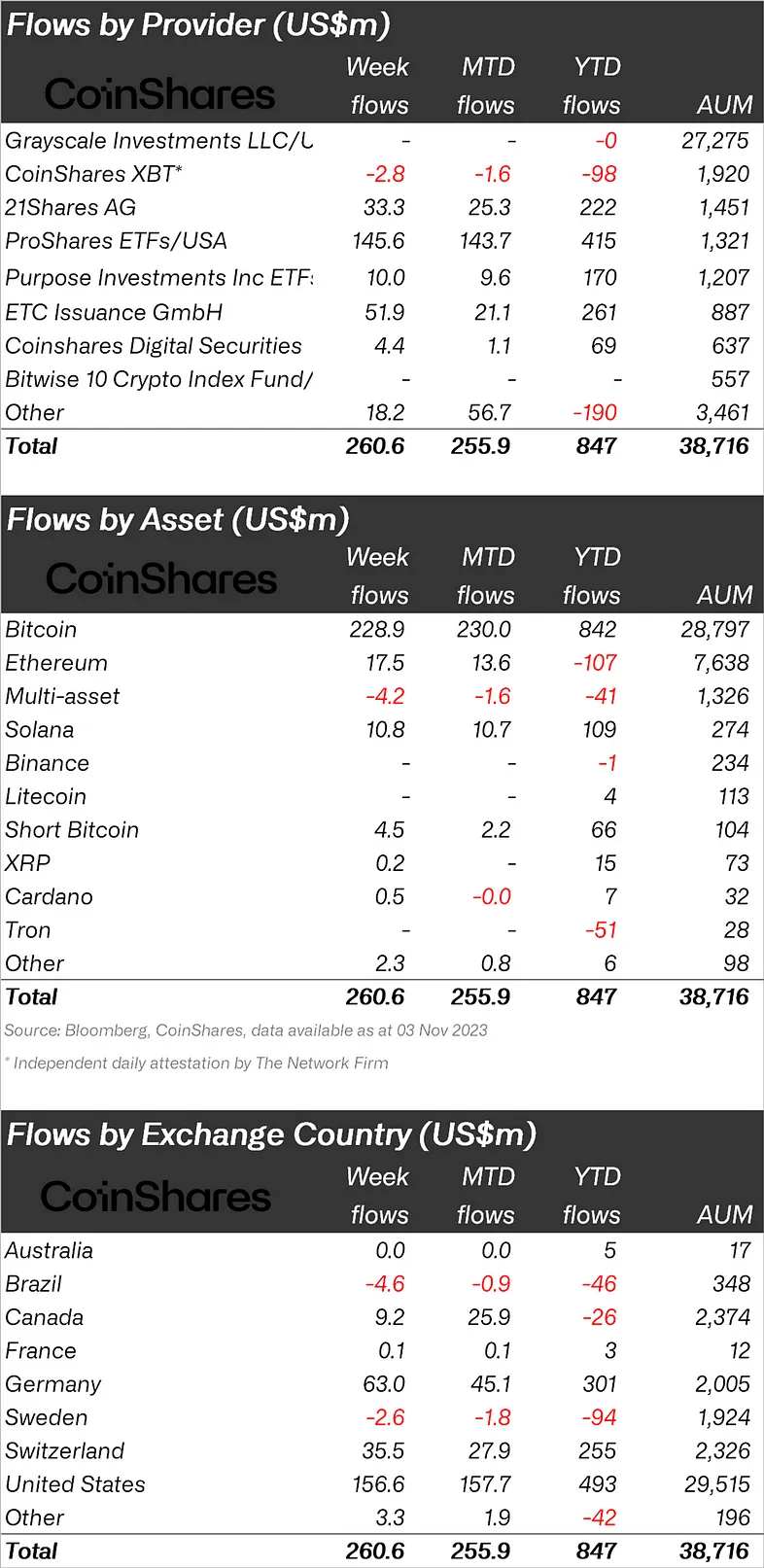

Stating that the positive atmosphere continues at this point and publishing its weekly cryptocurrency report, Coinshares said that there was an inflow of 261 million dollars last week.

“The positive atmosphere in the market continues with the total inflow reaching 261 million dollars in the 6th week.

“Cryptocurrency investment products have seen total inflows of $261 million, exceeding the $736 million total inflows seen in 2022, now totaling $767 million and representing the 6th consecutive week.”

When looking at crypto funds individually, it was seen that the majority of fund inflows were in Bitcoin.

While BTC experienced an inflow of $229 million last week, the largest altcoin Ethereum (ETH) saw an inflow of $17.5 million.

While there was an inflow of $4.5 million in the Bitcoin Short fund, which is indexed to the decline of BTC, this entry was an indication that some investors viewed the recent rise as unsustainable.

When we look at the altcoins, Cardano (ADA) experienced an inflow of $0.5 million and XRP experienced an inflow of $0.2 million.

“Bitcoin received the lion's share of total inflows of $229 million, with year-to-date inflows reaching $842 million.

These inflows were likely supported by the increased likelihood of a spot-based ETF approval in the US and weaker than expected macro data.

Ethereum, which suffered a terrible outflow of a total of $ 107 million this year, saw its biggest inflow since August 2022 with $ 17.5 million.

Other altcoins such as Solana (SOL) saw total inflows of $11 million, while Chainlink (LINK) saw inflows of $2 million, representing 17% of total assets under management.”

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an inflow of 156.6 million dollars.

After the USA, Germany ranks second with 63 million dollars; Switzerland ranked third with 35.5 million dollars, and Canada ranked fourth with 9.2 million dollars.

In response to these inflows, Brazil experienced an outflow of 4.6 million dollars and Sweden experienced an outflow of 2.6 million dollars.

*This is not investment advice.