Bitcoin's decline to $25,000 after staying at the $30,000 level for a long time caused the positions of many investors trading in futures markets to become liquid.

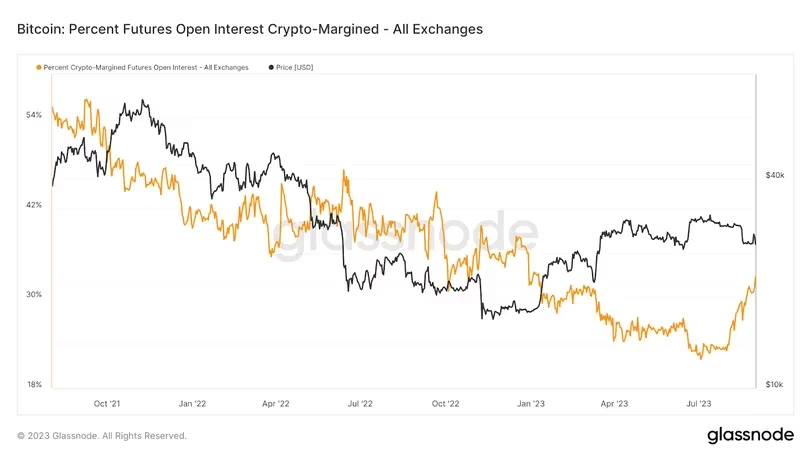

While individual investors mainly use USDT margin futures contracts, more professional investors use BTC and cryptocurrency margin futures contracts. The dominance rate of USDT margin and BTC margin contracts on the market also changes from time to time.

BlockBeats stated that there was a significant increase in BTC margin futures contracts and stated that this was a sign of high volatility.

BlockBeats interpreted the Glassnode data as follows:

“Bitcoin margin open interest rates increased to 33%. This may cause the volatility in the markets to be harsher.

According to data, the open interest rate in Bitcoin margin futures has increased from 20% to 33% since July. Cash or stablecoin margin contracts still account for 65% of total open interest.

“Renewed interest in BTC margin contracts could herald a major liquidation that could cause market volatility.”

We do not know clearly whether these contracts are short or long weighted. Therefore, it is not possible to predict whether the liquidation will result from a downward movement or a sharp upward movement.

However, we see that there is an expectation across the market that $20,000 will be tested again and the interest in Bitcoin has decreased. Since the market maker likes to move against market expectations, we would not be surprised if this high-volatility liquidation action targets short positions.

*Not Investment Advice.