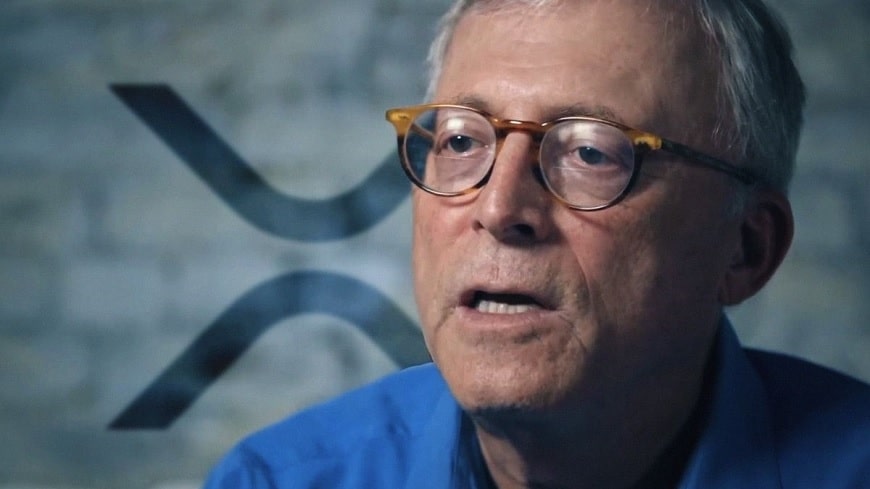

Veteran trader Peter Brandt has published a cautionary analysis on XRP, highlighting a potential downside move for the coin. Sharing his views on social media platform X, Brandt spotted a classic head and shoulders (H&S) formation in XRP’s price action, signaling a possible decline.

Brandt noted that XRP is currently locked in a trading range, with the H&S formation forming a significant resistance and support structure. Characterized by three peaks, the formation is considered a technical indicator of a shift from bullish to bearish momentum once the “neckline” support level is breached.

According to Brandt, the neckline is located around $1.90. If XRP breaks below this level, the formation predicts a downside target of $1.07. Elaborating on his outlook, Brandt said:

“I wouldn't want to be short above $3. I wouldn't want to be short below $1.90. H&S is moving toward $1.07.”

Brandt’s chart shows XRP fluctuating between the $2.9990 resistance and the $1.9000 support, with the last price around $2.45. The projected downside at $1.0714 is based on the height of the head and shoulders structure, a common methodology in technical analysis.

Acknowledging the controversial nature of his analysis within the XRP community, Brandt stated that his views are purely data-driven. He responded to potential criticism by saying, “No offense to the Messenger.” He also clarified his neutral position on XRP:

“To be clear: I don't care what XRP does. If it goes up, I want to be long. If it goes down, I will never go short.”

*This is not investment advice.